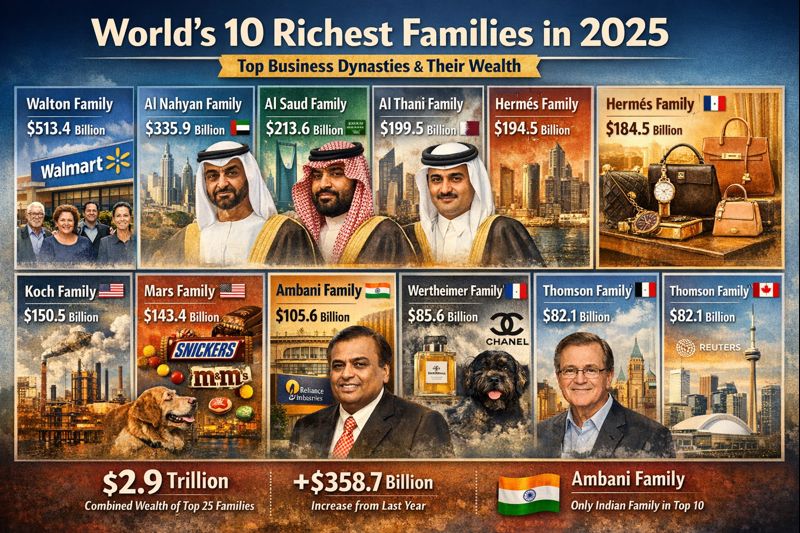

World’s 10 Richest Families in 2025: Inside the Biggest Business Dynasties on Earth

Global wealth in 2025 tells a familiar but fascinating story — power, patience, and inheritance still matter. Across continents, a handful of families continue to control industries, influence markets, and quietly expand fortunes built over decades, sometimes centuries.

According to the latest 2025 global wealth rankings by Bloomberg, the 25 richest families together now hold nearly $2.9 trillion, a sharp jump from last year. Strong equity markets, energy profits, luxury demand, and long-term investment strategies have all played a role in pushing family fortunes to new highs.

Unlike individual billionaire lists, this ranking focuses only on multi-generational wealth, excluding first-generation founders and single-heir fortunes. What remains is a clearer picture of how legacy businesses shape global capitalism.

Below is a closer look at the 10 richest families in the world in 2025, their businesses, and what keeps their wealth growing.

Why Family Wealth Is Rising Faster Than Ever

Several trends explain the surge in family fortunes:

- Global stock market recovery lifted valuations across sectors

- Energy and commodity gains boosted oil-rich dynasties

- Luxury consumption rebounded strongly, especially in Asia

- Private ownership allowed families to avoid market volatility

- Succession planning kept businesses stable across generations

For Indian readers, these rankings also highlight how rare it is for an Indian family to break into this exclusive global club.

1. Walton Family (USA)

Net Worth: $513.4 billion

Core Business: Walmart

Industry: Retail

Generations: 3

The Waltons remain unmatched. As founders of Walmart, the world’s largest retailer, they became the first family ever to cross the $500 billion mark. Despite Walmart’s everyday, low-margin image, its massive scale and global footprint continue to quietly mint wealth year after year.

2. Al Nahyan Family (UAE)

Net Worth: $335.9 billion

Status: Royal family of Abu Dhabi

Industry: Energy, investments, infrastructure

The ruling family of Abu Dhabi controls vast oil reserves while also investing heavily across global real estate, finance, and technology. Their wealth reflects not just energy income but decades of careful diversification through sovereign investments.

3. Al Saud Family (Saudi Arabia)

Net Worth: $213.6 billion

Status: Royal family

Industry: Energy and state-linked assets

The Saudi royal family climbed sharply in 2025 rankings, helped by strong oil revenues and strategic state investments. Economic reforms and large-scale development projects have also added long-term value to the kingdom’s assets.

4. Al Thani Family (Qatar)

Net Worth: $199.5 billion

Status: Royal family

Industry: Natural gas, global investments

Generations: 8

Qatar’s ruling family benefits from the country’s massive natural gas reserves, among the largest in the world. Smart overseas investments through sovereign wealth funds have ensured steady growth even during global slowdowns.

5. Hermès Family (France)

Net Worth: $184.5 billion

Core Business: Hermès

Industry: Luxury goods

Generations: 6

Unlike many fashion houses, Hermès remains family-controlled. Its strict supply control, timeless branding, and unmatched pricing power have turned handbags and scarves into one of the most profitable luxury businesses globally.

6. Koch Family (USA)

Net Worth: $150.5 billion

Core Business: Koch Inc.

Industry: Energy, manufacturing, chemicals

The Koch family runs one of America’s largest private companies. Their wealth comes from industrial operations that rarely make headlines but generate consistent cash flows across multiple sectors.

7. Mars Family (USA)

Net Worth: $143.4 billion

Core Business: Mars Inc.

Industry: Confectionery and pet care

Generations: 5

From chocolates like Snickers and M&M’s to a booming pet-care division, the Mars family quietly owns brands found in homes worldwide. Their privately held model keeps profits within the family.

8. Ambani Family (India) 🇮🇳

Net Worth: $105.6 billion

Core Business: Reliance Industries

Industry: Energy, telecom, retail, digital

Generations: 2

The Ambani family is the only Indian name among the world’s richest families. Founded by Dhirubhai Ambani, Reliance has transformed from a textile company into a global powerhouse spanning oil, telecom, retail, and digital services. Under Mukesh Ambani’s leadership, Reliance continues to redefine scale in India.

9. Wertheimer Family (France)

Net Worth: $85.6 billion

Core Business: Chanel

Industry: Luxury goods

Owners of Chanel, the Wertheimer family benefits from the brand’s timeless appeal. With strong demand for high-end fashion worldwide, Chanel remains one of the most profitable luxury labels per product sold.

10. Thomson Family (Canada)

Net Worth: $82.1 billion

Core Business: Thomson Reuters

Industry: Media and financial information

The Thomson family built its wealth through information — news, legal data, and financial services. As businesses rely more on data-driven decisions, their assets continue to hold long-term relevance.

What This Ranking Reveals

A few clear patterns stand out:

- Retail, energy, and luxury dominate family wealth

- Royal families still control enormous resources

- India has just one family in the global top tier

- Private ownership offers stability during market swings

For aspirants, investors, and current affairs readers, these families offer real-world examples of how wealth compounds across generations when businesses are protected, diversified, and patiently grown.

Bottom Line

The world’s richest families in 2025 are not just wealthy — they are institutions. Their influence stretches far beyond balance sheets, shaping industries, governments, and consumer habits worldwide. As markets evolve, these dynasties show that legacy, when managed well, can be the most powerful asset of all.